- 10 min read

Ditching Conventional Thinking to Invest in the Energy Transition

Touching every sector of the global economy, the energy transition has the potential to generate investor returns for nimble, innovative firms such as Tall Trees Capital.

- By: Tall Trees Capital

- January 28, 2025

Today’s energy transition is a structural megatrend that will impact every sector of the economy over the next few decades.

But it is not the first substantial energy transition the world has experienced.

Consider the broad uptake of coal through the second half of the 19th century.

Followed by the surge of oil and natural gas midway through the 20th century, although coal has remained a core source of electric power through today.

Both systemic transitions impacted everything from core necessities such as heat and shelter to discretionary activities such as how we got away for the weekend.

By a similar measure, today’s energy transition will ultimately impact every aspect of our lives and, from an investment perspective, it will provide a broad assortment of attractive investment opportunities for decades to come.

As to the latter, lessons from the previous energy transitions have taught us that potential gains will be both obvious and subtle. To capitalize on the less-than-obvious will require unconventional thinking—both in where to find such opportunities as well as how to approach them.

The flexibility to identify, assess, and act upon the best ways to invest in the energy transition is rare. It requires a unique skillset to merge the macro with the micro, combine broader energy trends with specific technological know-how, and understand how entire value chains interact.

Put Your Buckets Away

Perhaps the leading challenge for investment managers dedicated to the energy transition space is that prospective clients tend to immediately place related investments into one of two buckets:

1. Traditional energy

2. Green energy

Investors have long been conditioned to adhere to such black-and-white thinking, but given today’s landscape, it can significantly limit opportunities.

How?

When someone allocates a modest portion of their portfolio to energy, the default pick is traditional energy investments or those tied to the oil and gas complex.

When they direct capital towards green energy, it is usually driven by companies in the solar and wind space, where returns have recently been mediocre at best. Plus, some allocators automatically steer clear of renewables, having painted the asset class with the sustainable or ESG brush.

The simplistic thumbs-up and thumbs-down calls may have worked in the past, but this energy transition is far more complex and affecting much more of the global economy.

That is where our agility helps.

While we can make long investments in companies we believe are poised to grow and steadily benefit from the energy transition, we can also short stocks from companies we believe are disadvantaged.

Furthermore, as the transition plays out, there are industries seemingly unrelated to oil, gas, solar, or wind that will gain—or lose—from the new realities.

Consider data centers, where energy demand is expected to grow at a 15%-20% CAGR from 2023-2030, resulting in a consumption rate of 8%-10% of total U.S. power demand by 2030—up from about 3% currently. This creates a tremendous opportunity to invest in businesses that are benefiting across the energy value chain, such as leading producers of power transformers and combined cycle gas turbines, as well as companies enabling more energy efficient data centers via advanced liquid cooling technology.

Yes, Energy’s Still in the Mix. To a Degree.

Of course, energy sits at the core of the energy transition, which means our investment approach will have exposure to the sector.

How much? That is the subject of an off-and-on internal debate, but we ultimately come down on the side that we are investing in the energy transition, not running an energy fund.

For example, there are incredible technologies that help reduce energy usage, which the International Renewable Energy Agency projects will account for a quarter of the carbon reduction efforts through 2050.

How We’ll Get to Net Zero by 2050

Source: https://www.irena.org/Energy-Transition/Outlook

We are finding opportunities across multiple sectors of the global economy, including power producers, equipment manufacturers, infrastructure companies, mining firms, construction materials companies, technology, and utilities.

Furthermore, artificial intelligence (AI) will play an essential role in the drive to Net Zero, particularly on the demand side of the equation.

Think about the power transmission grid. Its complexity skyrockets when you plug in renewable energy sources, which by nature are intermittent. When the sun is shining and the wind is blowing, you have an abundance. On cloudy, windless days, there’s very little renewable energy generated.

AI helps manage supply and demand complexities on the grid.

Benefiting from Both Winners and Losers

As the world moves towards a low-carbon economy, here is the thing: There will be companies that create value and there will be companies that destroy value.

So, there will be stocks that are winners and stocks that are losers, and it will not be a zero-sum game.

Understanding that, our goal is to benefit from both the long and short sides of the trade.

And unlike many who only think “hedge” when it comes to shorting, we also think “alpha.” As in, a potentially solid contributor to portfolio returns, not simply the means to achieve a market-neutral portfolio.

The key to that?

A refined shorting model that features “boring shorts”. Not the stocks that are whipping all over with 20-point drops followed by 10-point jumps, but low-beta companies that have stretched beyond what is reasonable and therefore will likely grind down from current levels.

In a risk-reward context, such “boring shorts” offer solid potential returns and while they do not deliver in every market environment, they can provide considerable alpha in most.

The freedom to follow an unconventional path also has some benefits.

For example, a long/short approach to the energy transition has experienced less volatility than the broader market, and it has also resulted in significant unrealized alpha from names that are creating or destroying value amidst the move to a low-carbon economy.

A Boutique’s Freedom From the Obvious

While breaking away from the classic either/or mindset, much of our time is spent searching for non-obvious opportunities in capital goods, clean tech, solar, gas value-chains and materials that are overlooked by energy investors and misunderstood by the rest of the market.

While others debate how prominent renewables are—or should be—we have moved on to energy volatility.

More specifically, energy demand is going through the roof and with more and more renewables coming online, massive power grid bottlenecks are on the horizon. We can’t meet the demand because of issues with the power grid, which needs copper for expansions and upgrades.

Insufficient copper production is a tailwind for mining companies, just as the growth of data centers is bullish for natural gas producers. How so? Many data center operators are locating facilities near nuclear power plants, which will prioritize their new corporate neighbors and remove baseload power from the grid. To replace that core supply, most utilities will turn to gas-fired power.

Meanwhile, away from the distribution and production discussions, we believe an underappreciated slice of the energy transition is efficiency. When we’re wasting more than two-thirds of the energy produced in this country, there’s a lot in play for the developers of energy efficient technologies.

As we continually look beyond the obvious, our investment thinking crystallizes around four key pillars that reinforce our unconventional approach:

Renewables—Everyone’s decarbonization discussion starts here, but for too many, it also ends here. More power from renewable sources alone will not get us to Net Zero.

Electrification—Converting large, consumptive portions of the economy to electric power—think EVs, drones, etc.—is a huge undertaking, as well as expanding and upgrading the transmission and distribution network.

Low-carbon energy—Traditional energy sources are not going away anytime soon, and they need to be part of the solution. Carbon capture technologies and renewable fuels for use in aircraft engines and diesel motors can be effective.

Decarbonization—Perhaps the most exciting space longer term as it represents the possibilities of energy efficiency: warehouse automation, digitalization, and AI-driven technologies.

Forging A New Path

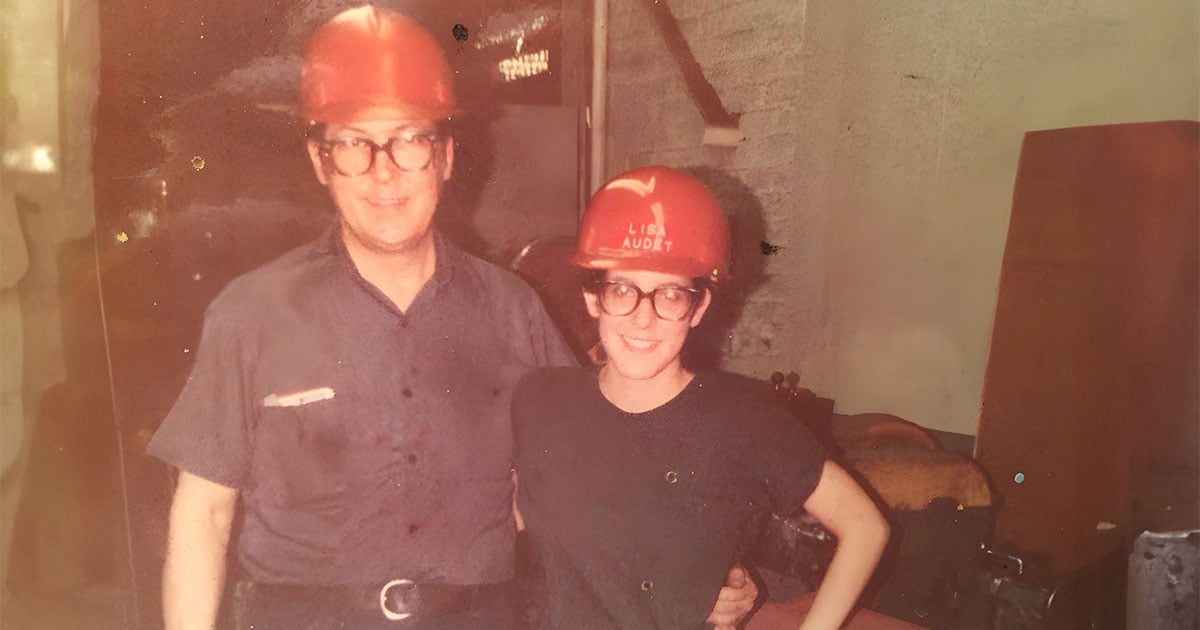

Our firm’s founder, Lisa Audet, spent a decade living, learning, and working abroad and has been part of the investment world for 30-plus years. Her fine-tuned values include:

- Focusing on sustainability and diversity

- Making a positive impact on the world

- Maintaining a supportive and collaborative environment

- Delivering strong idiosyncratic returns to investors

For those aligned, we believe the opportunities in the energy transition will be abundant over the coming decades.

Capitalizing on the ongoing global energy transition will require a new playbook that reflects the new realities of the worldwide energy landscape. Reach out today to explore our unique approach that bypasses traditional energy sector logic or subscribe to our monthly insights below.

TALL TREES CAPITAL