- 4 min read

Meet the Founder: Lisa Audet Found Her Edge in Energy

Discover how Tall Trees Capital founder Lisa Audet’s unconventional path has shaped her bold approach to investing in the energy transition.

- By: Tall Trees Capital

- March 14, 2025

In the ultra-competitive hedge fund industry, few leaders possess the unique experience, perspective, and tenacity of our founder, Lisa Audet. Her journey from working in a steel mill during summer breaks in college to Discovery Capital Management and, ultimately, to Tall Trees has shaped her bold approach to investing and her unique perspective on the energy transition.

Lisa shares the highlights of her journey here.

Succeeding in the hedge fund industry requires being both hungry and humble —qualities I exhibited even as a kid. I grew up in a blue-collar town in Connecticut, raised by hard-working, self-effacing parents. The apple didn’t fall far from the tree.

Living in Brazil as an exchange student changed my life. While studying abroad during my junior year in high school, I grew more confident, discovered I had a gift for languages—I learned Portuguese in three months—and decided I wanted to live and work internationally. So, after graduating, I went to college at The American University in Washington, D.C. and majored in international studies and economics.

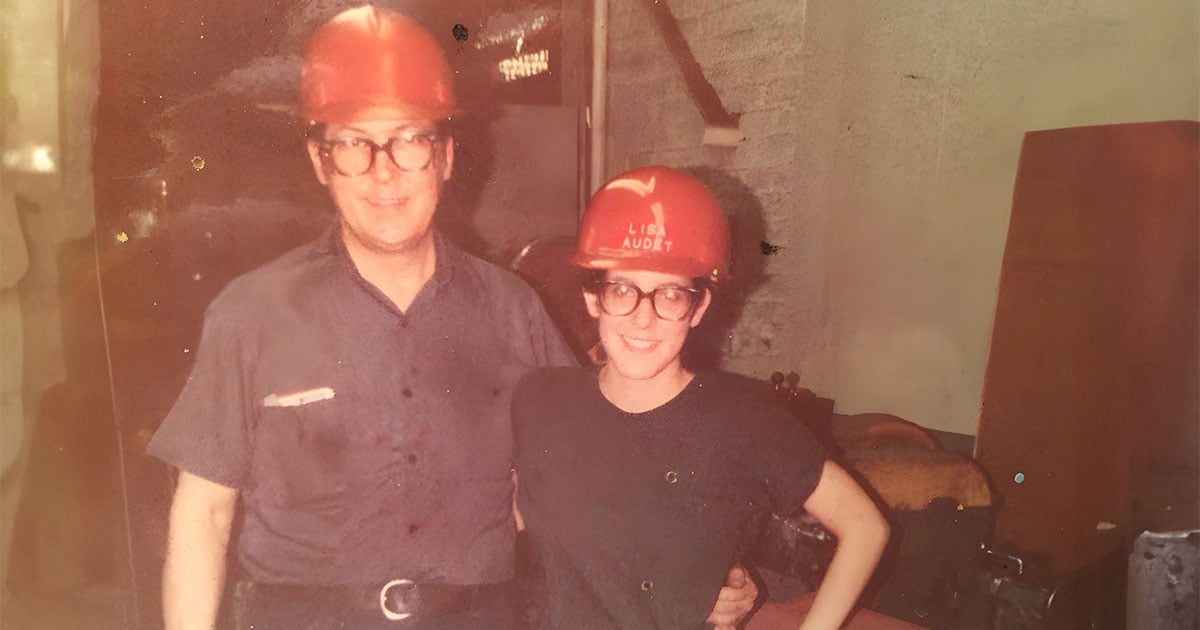

Growing up, I would watch my Dad pick up Barron’s on his way home from church every Sunday and read it cover to cover. He worked as a machinist at a steel mill and was a phenomenal investor. Both my parents were extremely intelligent. My mom worked as a bookkeeper before deciding to stay home with us kids. But it was my Dad who taught me to invest part of every paycheck. He also taught me the value of hard work. I worked with him at the steel mill during summer breaks while in college—steel-toed boots, hardhat, and all.

After college, I joined the Peace Corps. It was the beginning of my love affair with Africa. I spent two years in the Peace Corps in Cape Verde, a Portuguese-speaking island nation off the West Coast of Africa. After that, I took a position with a trade organization, guiding investors through Angola. Then, in 1994, amidst the post-civil war era in Mozambique and the historic election of Nelson Mandela in neighboring South Africa, I moved to Mozambique where I established and managed a representative office for HSBC Equator Bank. It was an exciting time. Businesses were re-opening, the economy was improving, and I gained valuable career experience.

After several years, though, I began to feel the tug of home. After I returned to the U.S., I was fortunate to be able to transition from banking to fixed income as an analyst covering high-grade and high-yield corporate bond investments at Hartford Investment Management.

My credit background, language skills, and experience living and working in emerging markets got me in the door at Discovery Capital Management. As an analyst at Discovery, I initially focused on emerging-market corporate opportunities. After the financial crisis, I shifted over to the equity side of the portfolio and started focusing on long/short opportunities in the energy and commodities space. Over time, the firm put more and more capital into my ideas and, by 2014, $1.2B of Discovery’s $16B AUM was allocated to energy and commodity investments. That level of exposure stayed relatively consistent through 2018 and generated about $500M in P&L during those five years—with twice the amount of alpha on the short side.

I was working at one of the best macro shops in the industry. But, after 12 years, it was time for a change. I was still excited about the energy sector, but even more so about the energy transition. Especially the role of technology in meeting growing energy demand while decarbonizing the global economy. So, in 2019, I decided to leave Discovery, start my own firm, and launch a long/short strategy.

Male or female, managing a hedge fund is tough. You need to have common sense and tenacity to be successful. One of the things that’s helped me is being part of a community of female fund managers who serve as mentors for each other and share investment ideas. Founded by Tracy Castle-Newman, who recently retired from Morgan Stanley where she was Global Head of Client Business Development in the Institutional Equity Division, the Women’s Investment Roundtable (WIR) helps members build connections, raise their profiles, share their investment ideas, and increase their access to capital. Tracy is amazing. She’s one of the women I respect and admire most in the investment world. I’m honored to be part of this wonderful and supportive community.

The energy transition is one of the most exciting global investment opportunities I’ve seen in my 25+ years of investing. It touches every sector of the economy, not just energy, and investment opportunities are limitless. Some asset managers in this space focus strictly on alternative energy—wind, solar, hydrogen. Others stick with traditional energy businesses such as oil and gas and only dabble in alternative energy. While I’m open to exploring such conventional opportunities, I look beyond the obvious. More specifically, I gravitate toward businesses that solve energy bottlenecks, and I invest in those that are either creating or destroying value.

I didn’t shy away from launching Tall Trees during one of the most difficult years on record for the markets. A strong work ethic and my incredible team made it possible. I have no doubt my unique background and ability to think outside of the box have contributed to our success. We’re finding what we believe are some of the most compelling opportunities represented by the secular, multi-decade themes found in the energy transition. With a strong foundation and a clear vision, Tall Trees Capital is poised for continued growth and innovation in this dynamic investment landscape.

Connect with us to learn more about our innovative approach to investing in the energy transition.

The global energy transition is a structural megatrend that represents trillions of dollars of investment opportunities in the coming decades.

In this webcast, our founder Lisa Audet sat down to discuss more about the global energy transition.

Interested in learning more about our pragmatic approach to investing in the energy transition? Get in touch or subscribe to our insights below.

TALL TREES CAPITAL